You may have heard the term ‘cashflow’ or ‘cashflow forecast’, but what does it mean? Quite simply put cashflow is the cash that flows in and out of your bank account – and a forecast is estimating how much money will be in your bank account and when it will be there!

Cashflow and money in the bank will never correspond to your profit and loss report. This is what you’ve earnt on paper, however this will never be the amount in your bank unfortunately! Profit is based on sales and purchases – whereas cashflow is based on when you make and receive payments – i.e. when the cash actually hits the bank.

Keeping an eye on your cashflow is just as important as keeping track of your sales – if not more so. It’s all good and well you are making plenty of sales – but if you don’t have the cash available to deliver your sales and pay all your bills you’ll soon run into trouble.

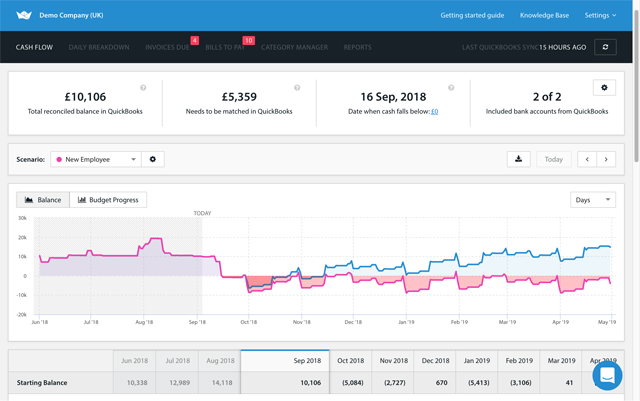

Preparing a cashflow forecast can help foresee any issues you have with cashflow, and will highlight any times when you possibly won’t have enough cash to pay the bills so you can prepare and make arrangements to deal with these problems in plenty of time (i.e. ask for longer to pay a bill/set up a payment plan, possibly apply for a loan, make more of an effort to get your sales paid etc).

If you want more certainty in your business let’s talk together about your future – visit our cashflow page to start your future today!