What kind of feelings does the word ‘budget’ bring about?

Control? Limitation? Responsibility?

It might not seem like a sexy word or concept. But getting a solid, dependable budget in place is actually a fundamental step to designing your dream life.

Especially if you currently:

- Don’t feel in control of your business finances.

- Need to know where your income is limited, or put limitations on outgoings.

- Want to take responsibility for your growth and improvement.

I’m going to show you how budgeting is the tool to take you from hiding under the covers from the big bad money problems to confidently progressing towards your financial goals.

If you want to be money confident in 2024, 2025, and beyond, budgeting is your best tool

We recently ran a money confidence masterclass for business owners who want to feel more in control of their business finances.

In the session we asked our attendees:

- What does success look like to you?

- What would you do if you won the lottery?

- What would you do if there were no barriers? I.e money, time, fear, childcare, technology, skills, that little voice in your head etc.

Some of the answers they shared were:

- Better work life balance

- Enjoy work but have meaningful time off

- Know I can pay the bills and enjoy the fun stuff without worrying

- More adventures with the kids

- Buy a property somewhere sunny

- Buy a house we all fit in

- Buy a reliable car

- Get a dream campervan

As you can see, money confidence isn’t about having ridiculous amounts of cash to flash. Most often for a business owner it’s about having freedom, security, comfort. Time to spend with the people you love the most.

Money confidence looks like:

- Being familiar with your living costs and saving goals.

- Having a clear picture of what your business needs to provide to give you the lifestyle you want.

- Being clear on any debts you have and have a plan to pay them off.

- Knowing what’s going on within your business and setting realistic sales and profit targets.

- Knowing you’re actually making a profit and can pay yourself (and give yourself the pay rise you’ve long deserved).

A bottom-up budget is what we recommend to our business owners who want to feel money confident and design their dream life.

A bottom-up budget is created by figuring out the amount of money you need for your lifestyle and building up from there.

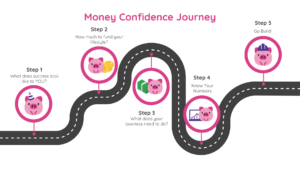

When a business owner goes through our money confidence course, we help them figure out:

- What success looks like to them.

- How much money they need for their dream lifestyle, day to day and longer term.

- What the business needs to do to deliver that money.

- What’s going on in the business financially and what changes need to be made.

- A practical action plan to achieve success.

As part of step 3 we help them build a bottom-up budget for the business. We start with the amount of money the business needs to provide for your lifestyle and we build from the bottom up!

Which means we total up:

- The taxes you need to pay (making sure you’re paying no more or less than you should be).

- Your overheads and admin expenses

From this we can work out:

- The gross profit you’d need out of your business.

- The sales targets you’d need to hit.

Once you know the target that’s going to deliver you the profit you need to achieve your ideal lifestyle, we can put plans in place to meet those sales and we can also quantify that to the number of clients or sales needed to achieve the sales figure.

If you’re getting serious about making a change to your financial situation, we are here to help.

The steps above are the same steps I follow myself and have helped me get to where I am today! Good accounting goes above and beyond the bookkeeping and tax returns – it’s taking them to the next step and actually helping you to build a business that gives you the life you dream of. Which is where we come in. We offer a range of accounting services to support every business owner – right from the smallest of side hustles up to those with teams of 20 or more! And we can also take your accounting to the next level with services like our Money Confidence Course.

Talk to us today about how we can help you on your journey – complete our Quick Questionnaire and we’ll be in touch to book in a discovery call. We’re here to make running your business that little bit easier.

For more tax tips and advice, check out PPF on YouTube.