We have a lot of new clients ask us what they’re entitled to claim when they’re making regular business trips in their own car,

If you use your personal car (or other vehicle) for business travel you can pay yourself an allowance from your company as an expense. This is a taxable expense, so any money you pay yourself will reduce your corporation tax bill.

It’s important first to explain what is meant by ‘business travel’. You might be thinking “Great, I travel to work every day!”. But sadly, travelling from home to your office or usual workplace doesn’t count. Business travel means any business related trip that is not your usual journey to work.

If you’re regularly on the road for business trips, here’s the important stuff you need to know.

You’ll need to keep a record of the journey

You’ll need keep a record of:

- The date

- Where you’ve travelled from and to

- The reason for your trip

- The number of miles you travelled (don’t forget to include there and back)

There are two ways you can keep these records.

- In a spreadsheet – you can download our free spreadsheet template here.

- By using an app – our personal favourite at Pink Pig is MileIQ (It’s like Tinder for mileage – it automatically logs trips as long as you have your phone on you. You swipe left for personal trips and right for business trips!). We also recommend Tripcatcher as an alternative.

What you can claim

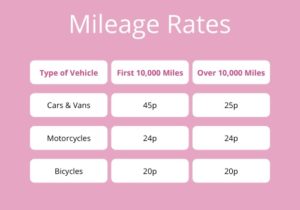

You can claim the following rates of mileage allowance depending on your vehicle:

The first 10,000 miles relates to the first 10,000 miles you travel in any tax year (so 6th April – 5th April), and then there is a rate over the first 10,000.

And yes, that is correct, no matter what your company’s financial year is, the mileage allowance is based on the tax year – which is another great reason to use an app that will work it out for you!

It’s worth noting that the mileage allowance covers fuel as well as wear and tear, and all the associated running costs of your vehicle. You can’t individually claim the mileage allowance, plus the cost (or % of cost) of the associated costs too.

There are a couple of bonuses to the mileage allowance you’ll want to be aware of

- Claiming for passengers in your car: If you have a passenger in your car you can claim mileage allowance for them too, providing they also work for your company. You can claim an extra 5p per mile per passenger.

- Claiming for a side hustle alongside your main job: If your business is your side hustle then you can have up to 10,000 miles for your main job as well as a second lot of 10,000 for your business. We can claim on your tax return if your employer doesn’t reimburse you. The only stipulation is that both your employer and your business can’t be under the same control. So if you have two businesses in your name, the 10,000 miles is split between the two businesses.

- Parking isn’t included! We said that the allowance covers the running costs of your vehicle and wear & tear, but that doesn’t include parking! So if you also pay to park at your destination then that is a separate business expense – yay!

More cash in your pocket for the driving you’re doing – it’s a no brainer

Mileage expenses is something you’re entitled to claim back, so as long as you’re doing it properly, it’s a great opportunity to reduce your tax bill. If you need more clarity on any of this information, or you have a specific situation and you’re unsure of how it applies – we’re always here to help you figure it out.