Cash Flow planning is best practice in any business and critical to survival and growth. Setting cash flow targets and regularly monitoring your actual cash flow against your forecast will enable you to predict large cash outflows and respond to changes in your business.

Inadequate cash flow is a symptom of management problems in a business, NOT the cause. Helping our clients look ahead with confidence and putting in place basic cash flow maximisation strategies is core to our purpose as your accountants.

What are the benefits of Cash Flow forecasts and management?

-

Assists with bank lending requirements

-

Identifies ways to avoid late payment penalties and interest from suppliers

-

Improves communication and relationships with your financiers and suppliers

-

Gives you an understanding of cash and liquidity for better decision making

-

Helps you understand the key cashflow drivers and the Cash Conversion Cycle in your business

-

Enables you to predict and plan for large cash outflows

-

Teaches you how to monitor your actual cash flow against forecast in your accounting or reporting software

-

Provides peace of mind that your cash flow needs are known and properly funded

-

Improves business processes that maximise cash flow, profit and business value

-

Drives your business to achieve your goals in a controlled and managed way

Who should use this service?

If you require a Cash Flow Forecast because your bank manager has requested one, we can create one for you. However, this Cash Flow Management service is fundamental as every business owner needs an understanding of cash and liquidity for better decision making. Recognising the difference between profit and cash, and the impact improving your Cash Conversion Cycle will have on your business is essential to managing and growing any business.

What is involved?

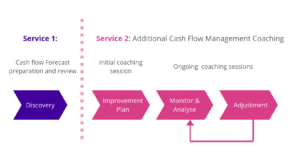

We have partnered with Float to bring you two service options, depending on our wants and needs. Both options include the completion of an annual cash flow forecast using Float, and then we have 2 levels of ongoing support.

Service one: A Cash Flow Forecast prepared with monthly updates and tweaks. Preparation of a Cash Flow Forecast and a one hour Cash Flow Forecast Review meeting to discuss and finalise the Forecast. We will then update and tweak monthly as required.

Service two: Cash Flow Management Coaching. Preparation of a Cash Flow Forecast along with a three hour Cash Flow Management Coaching session to:

-

Discuss and finalise the Cash Flow Forecast

-

Identify your current Cash Conversion Cycle

-

Identify the likely causes of cash flow problems within your business

-

Set 12 month and 90 day cash flow improvement goals and actions

This initial session is followed by four quarterly accountability coaching sessions, ensuring that you put in place essential cash flow management strategies and achieve your cash flow improvement goals. We will also update monthly and tweak each month as required.

When should I have a session?

Businesses should have a Cash Flow Forecast in place before the beginning of the new financial year. Having said that, we can provide this service at any time. The sooner we complete a Cash Flow Forecast for you, the sooner we can work together to agree strategies for improvement.

How do I start?

If you want a better understanding and more certainty over the cash flow in your business let’s talk together about your future!

If you’re an existing client simply email your Client Account Manager to ask to add cash flow forecasting and/or management to your services, and we’ll get you a proposal forwarded over.

If you are not working with PPF yet, then please visit our Work With Us page, complete the quick questionnaire and book a discovery call with us today!