*The Job Support Scheme has now been delayed due to the second national lockdown – the Furlough Scheme has been extended – check out the details in our extended furlough support blog*

The Job Support Scheme was announced as part of the Winter Economy Plan on Thursday 24th September. And then amended on Thursday 22nd October to give better support to those businesses under Tier 2 and 3 restrictions. But what is it and who will it help?

We don’t know all the facts, and how everything will work just yet, but here is everything we know so far.

What is the Job Support Scheme?

This new scheme will replace the Coronavirus Job Retention Scheme (CJRS) – or furlough! – which ends 31st October 2020.

The scheme will run from the 1st November 2020 and will support jobs for those who have decreased demand due to restrictions (referred to as Job Support Scheme Open). As well as supporting jobs where the businesses have been asked to close under Tier 3 restrictions (referred to as Job Support Scheme Closed).

How will it work? I hear you ask

Lets first look at JSS Open for those businesses who are able to open, but have much less demand (typically those in Tiers 1 and 2).

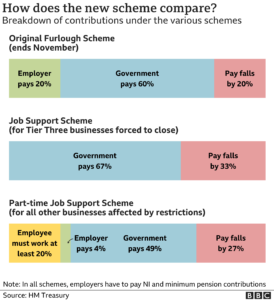

Employees will need to work a minimum of 20% of their hours – so someone who usually works full time, 5 days a week, needs to work a minimum of 1 day per week.

Of the hours not worked the employer will need to pay 5%, and the government will pay 61.67%. The government contribution is capped at £1,541.75.

The employee will therefore be paid a minimum of 73% of their usual salary. Employers can top up if they wish to.

Now for the easier one – JSS Closed for those businesses who are forced to close due to Tier 3 restrictions.

If your business is legally required to close, including those told to operation on a collection only or delivery basis, and your employees cannot work at all for one week or more then the government will pay 67% of the employees wages, capped at £2,083.33 per month. Employers do not have to contribute, but can top up if they wish.

We’ve pinched with pride this image from the BBC which shows the differences between the two, and how this compares to the previous Job Retention Scheme

Who is eligible for this scheme?

Anyone on the payroll as of 23rd September 2020 is eligible. This means employees who were not previously furloughed, or eligible for CJRS, can be included in this scheme.

Other details you need to know

- The scheme will run for 6 months from 1st November 2020 to 30th April 2021.

- The minimum working hours of 20% is set for the first 3 months, this may be increased for the remaining 3 months.

- Redundancies will not be permitted whilst using the scheme.

- An employer can claim the JSS Open and JSS Closed grant at the same time for different employees. An employer cannot claim for a single employee under both schemes at the same time.

- You can use this scheme and still claim the Job Retention Bonus in February 2021.

- Employers NI and Employers pension contributions will need to be paid by the employer.

- Wages will need to be paid by the employer, then the % paid by the government will be claimed afterwards.

- Claims can be made from 8th December onwards.

- Employers should discuss with their staff and make any changes to their employment contract by written agreement. When employers are making decisions, including deciding to whom they should offer reduced hours, equality and discrimination laws will apply in the usual way.

When will we know more?

We have been told we should have detailed guidance on everything by the end of October, once we know more we will let you know. I expect there will be a new claim portal and process set up in readiness for claims. Fingers crossed the claim process works as well as the current CJRS claims.

It is not clear if claims can be made for directors or not – hopefully the detailed guidance will confirm either way.

On the whole it sounds good for those who were planning on keeping as many employees as possible. Especially now the employer contribution for unpaid hours has been reduced. This will definitely give you some breathing space.

However, if redundancies is something you’re currently exploring, then is the job viable? Would this scheme really help keep the job, or just delay the inevitable, while continuing to cost you money you don’t have?

Check out our Support Hub for more on all the help available during the coronavirus pandemic.