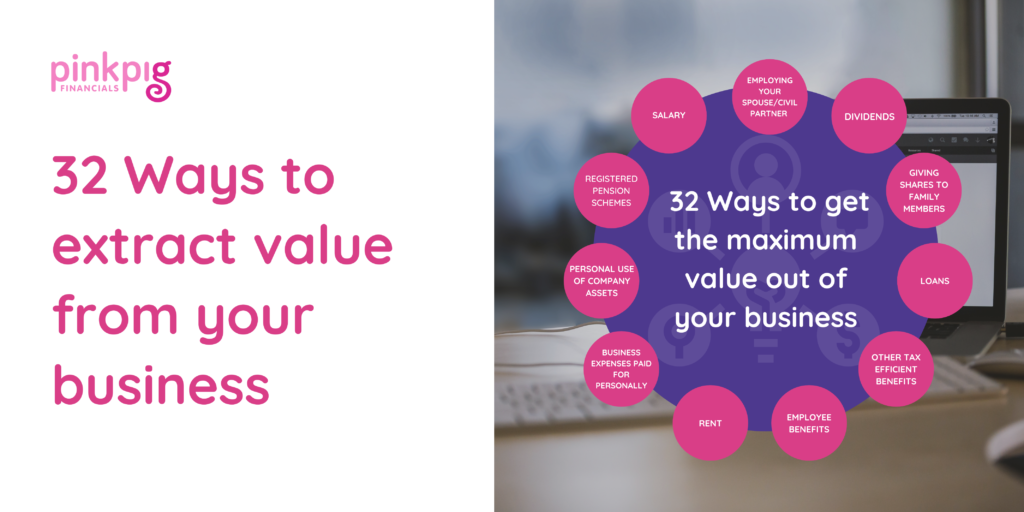

A question we get asked all the time is: ‘What can I take out of my business?’ and ‘how do I save more tax?’ Well, the quick answer is, ‘there’s up to 32 ways to get value out of your business, tax efficiently.’ Yep, that’s a lot of ways ⬇️

But the truth is, not all these 32 ways will be relevant to you and your business, and it’s likely that you’ll already be doing a few of them. But how do you know if you’re maximising every opportunity you could be, to improve your life, your families and your employees?

Value Extracting Tax Diagnostic Review

Well, we have a tax diagnostic review service that will do exactly that for you.

In our Value Extracting Tax Diagnostic review we will analyse your business and personal circumstances against the 32 ways, to identify all the ways you can tax efficiently put things through the business, or take value out of the business, benefitting you, your family and even your employees.

Every business owner can extract loads of value from their business, you just need to know what is relevant for you.

WHAT’S INCLUDED

As part of the tax diagnostic review we will:

- Complete a full analysis of the 32 ways to identify all the tax advice needs, tax saving opportunities, allowances, incentives and reliefs, applicable to your business.

- Produce a detailed report outlining all the tax advice needs, tax saving opportunities, allowances, incentives and reliefs, applicable specifically to your business.

- Produce an action plan outlining the priority areas for you and your business to focus on, including estimated tax savings and quotes for the delivery of recommended tax advice.

WHAT TO EXPECT

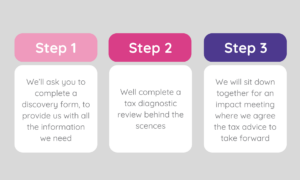

If you’re ready to go ahead with your tax diagnostic review, here’s what to expect:

STEP 1: Discovery Stage

We’ll gather the key information required about you and your business, in order to complete Step 2 the Tax Diagnostic Review.

STEP 2: Tax Diagnostic Review

We’ll run a Tax Diagnostic Review on you and your business, and analyse the findings, ready to share the results with you via the 45-min ‘Impact Meeting’.

STEP 3: Impact Meeting

We’ll invite you to a 45-min ‘Impact meeting’ where we will take you through the Tax Diagnostic results. We will explore three priority areas, explaining why it is relevant, the benefits and the tax savings.

Take Forward the Advice!

We’ll take forward any immediate any tax advice, and work with you to deliver your action plan.

FEES

The ‘Extracting Value’ tax diagnostic review is suitable for small stable businesses that are keen to explore the different ways to tax efficiently put things through the business, or take value out of the business to benefit yourself as a business owner.

Extracting Value Tax Diagnostic = £500 plus VAT

Tax Advice

At the end of your tax diagnostic review, tax advice will be identified to improve your tax position, to make a future saving, or to get cash back into your business.

Where tax advice is identified, we will provide calculated tax savings, a proposal of work and a quote for the delivery.

All tax advice will be quoted for separate from the tax diagnostic review fee.

Find out more about our tax services & pricing here.

Let’s have a chat

If you’d like to review how much value you’re getting from your business, we’d love to speak to you, book in a call & let’s have a chat: