At PPF we’re a big believer of not just looking at your numbers at year end so we’ve turned the Year End Accounts on it’s head and renamed them All Year Round Accounting!

We love to see businesses flourish; business growth is synonymous with business success and we can guide your established enterprise towards credible and continued financial growth.

Striking that work/life balance is not easy, at PPF we’re all about giving you time back.

Our efficient service and clear advice on easier ways to track your business and its financial health will leave you with more valuable free time to focus on growing your business and your personal life.

Building Solid Foundations

Getting the foundations set up and the bookkeeping running smoothly will help everything else work together. All of our clients use Xero with Dext Prepare (previously Receipt Bank) for the bookkeeping, which we are able to complete or help you to complete.

We are also able to run your payroll for you and your staff, as well as complete your VAT returns. Once these foundations are set up and running smoothly, we are able to concentrate on other aspects of your accounts and help your business to flourish, as well as complete the statutory year end accounts and Corporation Tax return.

Download our FREE Expenses Guide

Not sure what expenses you can and can’t include in your accounts? Download our handy guide of the expenses you can and can’t include.

So what is all year round accounting?

Well we don’t just look at your accounts at year end as is traditionally the case, we like to keep on top of your accounts all year round. We keep an eye on your sales so we know well in advance of when you’re nearing the VAT limit.

We also regularly check over your accounts, make required adjustments, and meaning we can spot any concerns before they become a problem – and then help to resolve them (ie with Credit Control, help with cashflow, as well as forecasting and budgeting).

We then prepare a quarterly report keeping you up to date with all the information you need, including upcoming tax liabilities, and ensuring you are taking dividends at the right level, as well as using the right salary/dividend mix.

Looking at your accounts on a monthly and quarterly basis rather than just at year end can ensure we spot opportunities for maximising tax efficiencies and growth sooner rather than later too.

Basically, this ensures that you have accurate, meaningful information at your fingertips at all times, not just 6-9 months after year end as was the old school way of doing things. We make the most of cloud accounting at its best to ensure you have everything you need to make the right decisions, and in real time.

Meaning not only do you have a better grasp on your tax liabilities, and know them nice and early, but you can concentrate on your own customers rather than worrying about the finances!

How does it work?

As we’ve said above, although your accounts and corporation tax returns are required to be filed annually, we don’t believe that some of the work should be done just once a year, once your financial year has ended. As we do the work during the year as we go it also means less work is required at year end, which of course speeds up the process!

During the year we will do the following:

Monthly

- Check bookkeeping completed to month end and queries cleared

- Check bills outstanding are correct

- Check sales levels for the last 12 months – are you approaching the VAT threshold?

- Review sales invoices outstanding/overdue

- Update Fixed Asset Register (FAR) and run depreciation

- Run monthly review – a 14 point audit including coding/vat treatment/irregular transactions and account reconciliations

Quarterly (usually inline with your VAT return if VAT registered)

- Check monthly tasks completed!

- Check PAYE/Pension/Wages Payable balances correct

- Check dividend levels to profit less tax & salary/dividend mix

- Prepare Quarterly Summary Report

- Quarterly fee review for clients with bookkeeping services for increase/decrease in transactional volume

It’s worth noting here, that these aren’t hard and set rules – for example we could check your dividend levels and salary/dividend mix more regularly depending on your personal circumstances, ie for those who are just starting out, or those with seasonal businesses. The above is a typical example of how we work with our clients.

Prior to year end

Around 2 months before your year end we’ll invite you to an annual review and tax planning meeting. Here we’ll review your year to date accounts, review your goals, and look at tax planning opportunities. We’ll also review your services for the coming year to make sure we’re doing everything we can to ensure you continue to move forwards, and towards reaching your goals.

At Year End

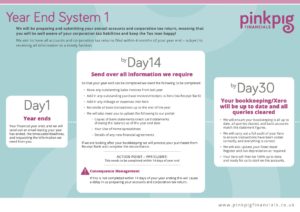

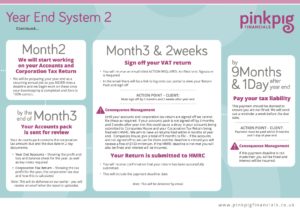

Then at year end our process is as follows and you can download a copy here too.

(Note: If we’ve been working with you during the year, then the adjustments and work required in steps 2 & 3 will be mostly for the last month of your year, and any final checks required, before moving on to step 4 and preparing your year end accounts and corporation tax returns).

Ready to get started?

Like to know more about how PPF can help you keep the tax man happy and help you work towards achieving your dreams? Head over to our Work With Us page, complete the quick questionnaire and book a discovery call with us. We look forward to hearing about you, your business and your goals.