In a nutshell the Employment Allowance is a grant towards your National Insurance (Class 1) payments that you pay as an employer. For the tax year 24/25 the Employment Allowance is £5000.

NOTE: from April 2025, the allowance will increase to £10,500, but the employer’s NIC contributions threshold will be lowered to £5000 and the rate will raise to 15%

What is Employers National Insurance Class 1?

If your employee earns over the NIC Threshold (currently £9096 for 24/25) then as the employer you will pay National Insurance of 13.8% for the part of their wages over the threshold. This is a cost to the business, not deducted from the employee (although they will also have employee’s NI deducted from their salary!).

How does it work?

Each year if you meet the eligibility, you are able to claim the allowance. This is done via the payroll software – and at PPF we do this automatically for all clients who are eligible and we run the payroll for.

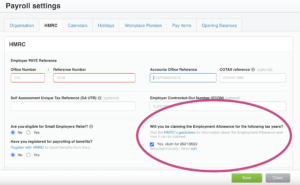

If you’re doing this yourself there is a little tick box in the Payroll settings on Xero, on the HMRC tab, that you need to tick, then click save and the allowance for the year will then be applied.

When do I get my money?

As ever with our friends at HMRC, it’s not *quite* as amazing as it sounds – you won’t be getting £5k paid into your account.

But, it’s the next best thing! The allowance will be deducted from your Class 1 Employer National Insurance payments each month until it is all used up, meaning that up to £5k less is physically leaving your account.

So if your Class 1 payment due for the first month is over £5000, then this will be deducted from your payment for Month 1 and you’ll just pay the balance (along with the Tax and National Insurance deducted from your employees).

However, say your Employers NI is £500 each month, then you’ll get £500 deducted for Months 1-10, and Month 11 onwards you’ll need to pay your Employer’s NI as the allowance will be all used up.

And sorry, but you’re not going to be getting the leftovers if you haven’t used the full allowance in the tax year.

Sounds great, who is eligible?

Businesses and charities with more than one employee can claim the allowance if their total Employer’s National Insurance bill was less than £100,000 in the previous tax year.

If you are a sole director with one other employee earning above the National Insurance threshold, or are 2 directors (with or without other employees) then you can claim the allowance,

Unfortunately sole directors completely on their own cannot claim (which is why at PPF, we keep your salary cleverly and efficiently within the thresholds).

I wish I’d known this before – can I back date a claim?

Yes – you can back date a claim for up to 4 years – so if you haven’t claimed and are eligible then get claiming (and for these you will receive a refund of monies paid up to the relevant allowance for the tax year claimed). You will either be able to claim via Xero as shown above, or if this is not, it is available via the RTI Tools from HMRC.

HMRC will send you a letter to confirm

They’re always a bit late to the party, but they will send you a letter at some point during the tax year (often literally the following April!) to confirm that you have been awarded the allowance. We would have been claiming/using the allowance since it was applied at the beginning of the tax year (or when your payroll started if it started part way through a tax year), so this is for confirmation only, and nothing further you need to do. You should keep a copy for your records, but other than that you’re all done!

I hope this clears up any confusion around the Employment Allowance, however if you’d like to discuss your eligibility or anything employment allowance related, please do not hesitate to drop us an email on hello@pinkpigfinancials.co.uk.

And if you’re really bored or want some bedtime reading, here’s the full details from HMRC.