VAT, such a simple word (or abbreviation if you want to be picky), but such a complex area of tax!

Once you hit the sales threshold (currently £85,000) in any rolling 12 months (so not the calendar year/your financial year/the tax year) you’ll need to register for VAT. Once registered you’ll need to charge VAT on your sales, and you can then also claim any VAT paid on your purchases.

As part of our standard accounting service we’ll keep an eye on your turnover to make sure you register in plenty of time, so that’s the first part covered. We’ll also set up your Xero to ensure you’re charging VAT correctly, and you’re all set up to claim VAT back where possible.

You’ll also need to file a VAT return – most commonly this is quarterly, but could also be annually or monthly. And the VAT return must be filed through software under the new MTD (Making Tax Digital) rules – but don’t stress about that – at PPF we have been preparing and filing through software for years, well before it was mandatory, so we’re well on top of that.

In the video below we talk more about how VAT works, the registration process, and how the returns work – so if you’re getting close to the threshold, or just new to VAT in general this video should answer some, if not all of your questions.

At PPF we’re deadline focused when it comes to our clients returns. We can take care of your VAT return so you can relax knowing you’re complying with all the rules and regulations, and your returns will be filed in plenty of time each quarter.

How does it work?

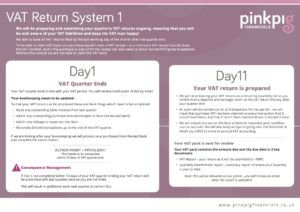

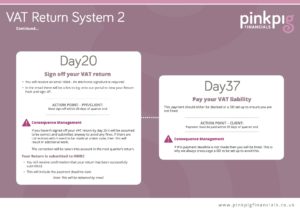

We take a 5 step approach:

- We create a recurring quarterly job in our job management system so we NEVER miss a deadline and begin work on the VAT return the day after the quarter end

- We carry out an audit of ALL transactions for the period – checking that purchase VAT has been claimed on every transaction it should have, and conversely that it hasn’t been claimed where it shouldn’t have been.

- We ensure you’re on the best scheme to maximise your cashflow – We’ll advise and decide on whether you need to be on a cash or accruals scheme. We also keep an eye on going over the threshold at which you HAVE to move to accruals by obligation

- We’ll send you notification of the amount due within 3 weeks of the quarter end (subject to receiving records from yourselves in sufficient time), giving you 2 weeks notice of the amount to be paid

- We file the VAT return on time, every time.

Basically, with PPF looking after your VAT you can get back to family days out rather than stuck sorting your VAT returns!.

Check out our process guide below, and you can download a copy for your reference here too.

Our top 6 VAT blogs:

- What is VAT? Learn more about the basics of VAT and how it all works.

- Why doing your VAT returns is not just a click of a button like some software companies can lead you to believe!

- What is a VAT receipt and why you need one

- Reverse Charge VAT for the Construction Industry

- Should I register for VAT voluntarily?

- The different types of VAT schemes

Ready to get started?

Like to know more about how PPF can help you keep the VAT man happy and help you work towards achieving your dreams? Head over to our Work With Us page, complete the quick questionnaire and book a discovery call with us. We look forward to hearing about you, your business and your goals.

PS. If you need some bed time reading to send you to sleep – here’s the HMRC manuals all about VAT!