As the shareholder and director of your limited company you will usually also be employed, and take a salary from the business using PAYE (Pay As You Earn). To do this you’ll need to run payroll, and file a return to HMRC each month.

Depending on your circumstances, and if you have other income sources, you’ll have your salary set at an optimal level to be tax efficient. For most people, if you have no other source of income you’ll have a mix of low salary and high dividends. (We’d look to establish the right mix for your personal circumstances during our proposal meeting so you’re set up in the best way from day 1, then tweaking as/if your circumstances change).

Once you take on employees they’ll also need payroll running to pay them each month. You’ll need to deduct tax and national insurance at the right rates, as well as enrol them in an auto enrolment pension (if eligible) and make the necessary deductions. You’ll also need to ensure you’re paying your employees at least the National Minimum Wage, which increases each year.

At PPF we’re able to take care of your payroll ensuring the right deductions are made at the right time, returns are filed on time and the regulations for auto enrolment are complied with, as well as ensuring that the Employment Allowance is applied correctly.

We’re also able to administer payrolling of benefits, redundancy pay, statutory sick pay, statutory maternity pay and other statutory leave, and other payroll related payments and deductions.

If you’re not yet registered with HMRC for PAYE then we can also get you registered and all set up ready to run monthly payruns.

How does it work?

Whether it’s director only or a larger payroll with employees, we’ve got it covered. We use Xero Payroll to run the payroll, file the returns with HMRC and where applicable file the pension return with the pension company. Your employees will be invited to download the Xero Me app where they can view their payslips, as well as update their personal details.

Once payroll is run the relevant costs and payments due to HMRC and pension company are posted straight into your accounts on Xero, ensuring that payroll costs are included automatically in your profit and loss reporting.

We’ll also email you to confirm payments due to yourself and employees, as well as what’s due to HMRC, and when!

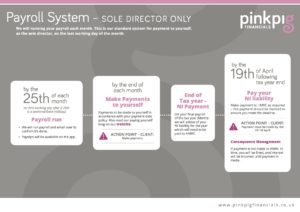

Here are our processes for director only payrolls (download here)

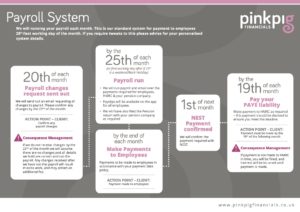

and dual director/multiple employee payrolls (download here).

And at the end of the tax year we’ll issue each employee with their P60 via email, and we can also prepare P11Ds as required for benefits such as cars, medical insurance and so on.

What else do I need to know?

When you take on your first employee there are other factors to take into consideration. They’ll need an offer letter and a contract issued as a bare minimum. You’ll also need to ensure you have employer’s liability insurance in place for when your first employee starts (you don’t need it just for yourself/co-director).

You’ll also need to have an understanding of holidays (each full time employee is entitled to a minimum of 28 days holiday – 8 of which are the standard Bank Holidays).

Depending on your circumstances and size of your team then you may need a full HR service. However for small teams and basic requirements we are able to help – check out Pink Pig People and Culture for more information.

Ready to get started?

Like to know more about how PPF can help you keep your team and tax man happy, as well as help you work towards achieving your dreams? Head over to our Work With Us page, complete the quick questionnaire and book a discovery call with us. We look forward to hearing about you, your business and your goals.

And don’t forget to ensure you have set up your online tax account so you have full visibility of your account balance with HMRC. Find out more here.