You wouldn’t build a house without solid foundations, and similarly you can’t do a set of accounts without good bookkeeping. Bookkeeping really is the foundation of your finances. Get this bit nailed and everything else flows from there.

Here’s the definition of bookkeeping:

Bookkeeping is ensuring that transactions – the ins (sales) and outs (purchases) are categorised correctly, so they are in the correct place in your accounts. Also ensuring the correct VAT treatment is applied if VAT registered. It’s matching up your invoices and receipts to your bank statement and making sure that everything balances and is accounted for.

It’s important to not only get it right, but also keep your bookkeeping up to date. This then gives you meaningful real time data to base all of your business decisions on.

Software is a great aid to bookkeeping, and there are many different options out there. At PPF we only use Xero, as we believe it’s the best option for small businesses. But even with the best software in the world – if you don’t input the information correctly, then the data will be useless.

option for small businesses. But even with the best software in the world – if you don’t input the information correctly, then the data will be useless.

With our bookkeeping software you can relax safe in the knowledge that everything is being recorded correctly and you have all the information you need at hand to make the right decisions for you and your business.

How does it work?

As we said above, at PPF we only use Xero to do the bookkeeping. We also insist on using Dext Prepare (previously called Receipt Bank). This is a handy little app on your phone which lets you take pictures of receipts as you buy things, and forward on receipts/purchase invoices you receive on email to a specific email address. This is the most straightforward way to get all your paperwork to us – all be it in a digital format.

We’re then able to process the receipts, allocate them to the correct category, and apply the correct VAT treatment, and push through into Xero, along with a picture of your receipt (which means you don’t need to keep a mountain of receipts up in your loft – yay!!).

In Xero we’ll connect up your bank (called a bank feed) and the statement lines will flow through into Xero each day from your bank. We’re then able to match up your receipts and sales to the relevant statement line, and account for any transactions without the matching paperwork, allocating them to the right place. This ensures that everything you receive and spend is accounted for. And more importantly accounted for in the correct way.

Even those little expenses you pay for out of your personal pocket – snap the receipt and we can make sure it’s included – and the amount spent is allocated as due back to yourself. We also ensure that only allowable expenses go through your accounts, so you’re not including something that is not allowable ends up in your profit and loss report! Check out our expenses guide below for more on what can and can’t be included.

We aim to do all of this at least 3 days a week, so your accounts are as up to date as possible.

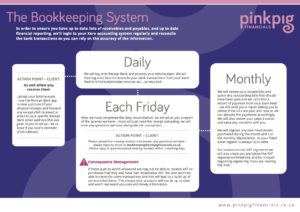

Here’s our standard process for you to see in more detail how it works, and what we do and when. You can download a copy too for your reference.

With our bookkeeping service you can get back to doing what you do best. No more trying to keep your books up to date on a weekend – giving you more time for family and friends.

Download our FREE Expenses Guide

Not sure what expenses you can and can’t include in your accounts? Download our handy guide of the expenses you can and can’t include – we have versions for both Sole Traders and Limited Companies.

How do you price bookkeeping?

The old traditional pricing model was on an hourly basis – but we don’t feel that is fair – on either party!

Therefore we feel the fairest way to price is on transactional volume. We charge per invoice/receipt we process from Dext through to Xero, and then per bank statement line we reconcile.

We review these transactional volumes each quarter, and adjust fees up or down as your volume fluctuates. Therefore as you grow, or in busy periods, and your transactions increase, so will your fees, as we’re doing more work. But similarly during quieter periods when your transactions decrease, so will your fees.

For more on pricing please check our our blog: How much do you charge?

Ready to get started?

Like to know more about how PPF can help you keep you build solid foundations in your accounts and save you time, as well as help you work towards achieving your dreams? Head over to our Work With Us page, complete the quick questionnaire and book a discovery call with us. We look forward to hearing about you, your business and your goals.