The start of Making Tax Digital (or MTD for short) happened on the 1st of April 2019 and it’s the biggest shake up the UK tax system will have seen for many years.

HMRC’s main goal of MTD is to make tax administration simpler, faster and more efficient when it comes to us managing our accounting processes. It is also HMRC’s aim to become one of the most digitally-advanced tax administrations in the world, but ego aside, MTD is a good thing.

The first phase started with VAT

Back in April 2019, this process started with VAT, and specifically with those over the £85,000 registration point. It then was extended to any business registered for VAT. Those registered for VAT need to file their VAT returns through MTD-friendly software for all returns.Here’s a throw back to March 2019 when I joined Xero’s MD Gary Turner on the LBC Breakfast Show talking about the first phase of MTD:

The second phase will be Self Assessment

MTD for Income Tax Self Assessment (or ITSA for short) is due to come into play from April 2024 for sole traders and landlords – this has been delayed a few times – so could be again, however Xero are already gearing up for Beta from April 2022. ITSA will affect sole traders and landlords with income/sales (NOT profits) of over £10,000 per year. So this is what you receive from your clients/tenants before any expenses are taken off. Therefore it is quite likely that many people will be affected by this phase.

Partnerships with income over £10,000 will get an extra year and will need to file by software from April 2025.

If you are affected then first of all you will need to update your year end to be 31st March to be in line more or less with the tax year. You will need to file 4 quarterly submissions to HMRC via software for EACH business – these will be roughly as follows:

Quarter 1 – 1st April – 30th June – expected filing by end of July

Quarter 2 – 1st July – 30th September – expected filing by end of October

Quarter 3 – 1st October to 31st December – expected filing by end of January

Quarter 4 – 1st January – 31st March – expected filing by end of April

You will also need to file an end of year submission for EACH business.

And finally, you’ll need to do a final submission for the INDIVIDUAL covering all income streams – pretty much the tax return as we know it today!

Now this does feel like a lot – but it’s not as bad as it first seems. Ensuring you’re up to date with your bookkeeping will be vital. The actual filing then shouldn’t’ be too much of an issue. And the two end of year submissions will pretty much re-confirm what you’ve already filed.

It’s also worth noting that at present payments are expected to remain as is currently – January, plus payments on account in January and July.

For landlords: It is the individual’s share of property income that counts towards the £10k threshold. Properties are not treated as separate businesses under MTD ITSA, so individuals need to calculate the rental income received from the one or more of the properties they own (or own a share of). Therefore if the individual receives over £10k pa in rent across all properties combined, whether from full ownership or part ownership, they fall under MTD ITSA.

The third phase will be Corporation Tax

The third phase of MTD will be Corporation Tax, which is due to come in from April 2026. We don’t know much about this as yet – but we do know that quarterly filings will be required via software – I expect very similarly to how VAT works. I expect we will probably hear more once ITSA has started to roll our successfully – and it wouldn’t surprise me if this gets delayed again too! However – I would still recommend getting your businesses set up on software asap and you then have plenty of time to get used to this transition before MTD comes into play – and you also start reaping the rewards that software brings!

Please don’t panic!

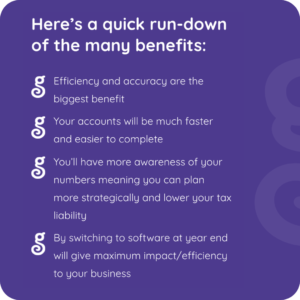

MTD doesn’t need to be a big scary thing; the new tax rules will ultimately help small businesses get a better grasp on their finances. Yes,HMRC is making us all do this gradually and nobody particularly likes change, but the benefits of taking your business digital are a real game changer.

HMRC is very aware that businesses will need time to adjust to the new processes and become more familiar with the requirements of MTD.

During the first year of each phase, HMRC will be lenient with businesses who can demonstrate they are doing their best to comply with the new rules.

If you’re not already using software, don’t panic, we can help!

What should I do?

As an existing PPF client, or anyone already using Xero, you will have nothing to worry about as both us and Xero are putting in plans for phases 2 and 3, so we are ready well ahead of the mandatory deadlines. For all of our annual accounting clients we’re already in the quarterly process, so this will just mean an extra report/filing will need to be done.

If you are not yet on software then now is the perfect time to start looking at options to see what will work best for your business. Why wait until HMRC make it mandatory for you to use software – why not start reaping the rewards now?!

As more information becomes available from HMRC, and Xero get closer to releasing their solution we will then be able to communicate this and advise exactly what will happen and when. But for now – the best thing you can do to get ready is to start making steps to switch your business over to your preferred software – and of course we totally recommend Xero for this!

In January 2022 we will be holding a webinar showing you how Xero will help your business and why you should be starting that switch sooner rather than later. Check out all the details, and register your free place here: Ramp up your business with Xero Webinar