We’d like to introduce you to one of our partners iwocaPay, who are improving the way small businesses are paid.

What is iwocaPay?

iwocaPay is a payments platform that can be added to your invoices, website, and just about anywhere. The goal of iwocaPay is to make it easier for your customers to pay you and improve your cash flow.

How does it work?

Once you’ve set up an iwocaPay account, you can connect it to Xero and add payment links to your invoice. When your client comes to pay, they’ll have the option on how they want to settle up;

- Pay now which is a smart alternative to card payments, and once your customer has paid, the money is in your bank account straight away.

- Pay in 3 lets customers spread the cost of an invoice over 3 months and you get paid instantly and in full, with iwocaPay taking on any and all risk – meaning you’ll never be asked to pay if your customer misses a payment.

- Pay in 12 offers the same as above but gives your customers the option to spread the cost over 12 months.

If your customers chooses to pay now, they can do so using Open Banking technology in under 2 minutes – no getting out card readers to log onto internet banking, no setting up a new payee, no faffing around! Just quickly and easily. And you get paid immediately, with NO FEE!!!

If your customer chooses to pay in 3 or 12 they can pay early anytime without extra fees. As with pay now you will get paid immediately. You can pick if its free for you, or interest free for your customers and there’s no hidden subscription fees and no maximum or minimum number of invoices you can use iwocaPay with. It just needs to be a B2B (business to business) invoice with a value between £150 and £15,000.

-

No more chasing invoices – Get paid right away and take control of your cash flow. Go back to doing what you do best and have the funds to do it.

-

Never be out of pocket – Offer better payment terms with less risk. iwocaPay will never ask you for the cash if your customer doesn’t pay them.

-

Make more (bigger) sales – Let your customers pay later so they can use you more now. Increase their invoice value and how often they go to you.

Check out this video showing you what it’s like paying with iwocaPay:

Don’t just take our word for it though!

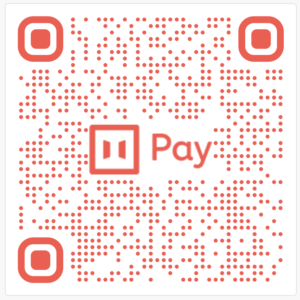

Why not try it out for yourself, by donating £2 to Mental Health UK using the QR code below or this link. You can then see first hand exactly how quick and simple it is to make a payment using iwocaPay.

If you love what you see (and frankly, why wouldn’t you?!) and are ready to sign up, click on the link below and sign up with iwocaPay, their onboarding team will help get everything set up! If you want to know more, drop us an email on hello@pinkpigfinancials.co.uk

p.s. If you use the link above, you’ll get a £100 voucher of your choice!