As a director of your limited company you’ll need to file a tax return each year to declare your salary and dividends. Along with any other income (like rental property, investments etc) and things like your student loan repayments and the Child Benefit High Charge if applicable.

We know it’s a chore that often gets left to the last minute (cue that January panic!), so our aim is to make the process as painless as possible! And spoiler alert – it will be done well before January!

How it works?

The director’s tax return process starts on the 6th April each year, just after the tax year ends. We aim to have all of our directors’ returns filed by the end of October each year – so you’re aware of the tax payment(s) due in plenty of time – no nasty surprises.

You’ll also get reminders of what to pay ahead of the January 31st deadline, and July 31st payment on account payment deadline – so you never need to worry about forgetting.

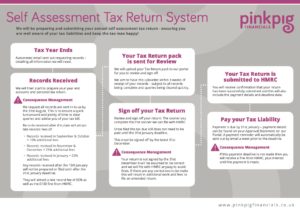

Here’s the full process we follow and you can download a copy here too.

Ready to get started?

Like to know more about how PPF can help you keep the tax man happy and help you work towards achieving your dreams? Head over to our Work With Us page, complete the quick questionnaire and book a discovery call with us. We look forward to hearing about you, your business and your goals.

Top 4 Related Blogs:

- What are payments on account & how do they work?

- Why am I paying Corporation Tax & Personal Tax – shouldn’t I just have one bill?

- I can’t pay my tax bill – help! What do I do?

- Setting up your HMRC Online Services Account

PS. We only do tax returns for our directors, whose limited companies we look after. If you are a sole trader, landlord, or need to do a tax return for any other reason check out our recommendations for you.