On Wednesday 23rd March, Rishi Sunak presented his Spring Statement 2022. He opened with his acknowledgement of increased living costs, which have been fuelled by supply chain issues and the invasion of Ukraine. Here we summarise the main points covered in the Statement.

The Statement was based on a three-part tax plan to strengthen the economy, with focus being on:

- Helping families with the cost of living;

- Supporting growth in the economy;

- Sharing the proceeds of growth fairly.

Helping families with the cost of living

The following will be implemented to cushion the effects of increased living costs:

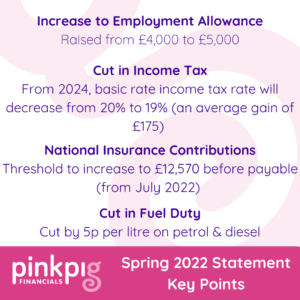

- From 6pm on 23rd March 2022, the fuel duty on petrol and diesel will be reduced by 5p per litre for the next 12 months.

- From July 2022, the Primary Threshold for Class 1 National Insurance Contributions (NICs) and the Lower Profits Limit for Class 4 NICs will increase to £12,570. This means that the first £12,570 of an individual’s earnings will be completely tax free.

- The Employment Allowance will be increased from £4,000 to £5,000 from April 2022, which will reduce employer’s Class 1 National Insurance for eligible companies.

Supporting growth in the economy

The Chancellor noted in his speech that UK companies invest 10% of GDP each year, compared with competitor countries who invest 14% of GDP each year. They plan on incentivising businesses to increase their investment by:

- Cutting and reforming taxes on business investment;

- Reviewing whether the current tax system suitably encourages businesses to invest in high-quality employee training;

- From April 2023, all cloud computing costs associated with Research and Development (R&D), will now qualify for tax relief. The R&D tax reliefs will continue to be reformed and improved at the next Budget.

Sharing the proceeds of growth fairly

Rishi Sunak also commented that the success of these tax reforms in growing the economy should be shared by everyone and in order to do this, the basic rate of income tax will be reduced from 20% to 19% from April 2024.

He also aims to make the tax system simpler, fairer and more efficient by continuing to further reform some reliefs and allowances ahead of 2024.

Summary

To summarise, the main highlights from the Spring Statement 2022 are:

- Fuel duty will be reduced by 5p per litre for 12 months from 23 March 2022;

- The Primary Threshold and Lower Profits Limit for Class 1 and Class 4 NICs will be increased to £12,570 from July 2022;

- The Employment Allowance will be increased to £5,000 from April 2022;

- Cloud computing costs associated with R&D will now qualify for tax relief;

- The basic rate of income tax will be reduced to 19%.