Congratulations on deciding to set up your own business! We know that starting your new company is exciting and scary in equal measures! There’s tons of fun stuff to do like choosing your company name, designing your logo and branding, setting up your website and socials, meeting potential clients, making your first sale, and many other things. But we also know some of the things can be quite daunting, especially when it comes to ensuring the tax man is kept happy!

At PPF we can guide you through the process of setting up your company. We can firstly ensure you’re using the right structure for your company, but then also setting it up in the right way – with the right shares, the right people as directors and shareholders, with the right taxes set up too! It’s not a one size fits all, so we ensure everything is as you need it, and will ensure it meets not just your needs today, but also the needs of your future plans.

At the same time as forming your company we can also carry out your PAYE, VAT and CIS registrations as required. And manage these registrations ensuring everything is set up in the correct way (and that you are registered for only the taxes you need to be!).

With our limited company formation service you can relax knowing that we’re taking care of the set up and keeping the tax man happy, so you can focus on doing all the other things in getting up and running as quickly as possible.

Download our handy start up checklist of everything you need to do when setting up your business (with all the things that we take care of as part of our service already checked off for you – you’re welcome!)

What if I already have a business, but am currently a Sole Trader/Self Employed?

If you’re looking to transition from Sole Trader to Limited Company we can also help. We can take you through your options to ensure this is definitely the right route for you, and your future plans, and take you through the process too.

How does it work?

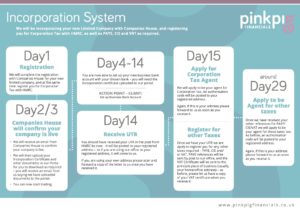

Check out our process guide below, and you can download a copy for your reference here too.

Oh, and don’t forget to set up your online HMRC account as you start to receive your references from HMRC – find out more, and how to do this here.

If you’re ready to get started, or have any questions at all, just head over to our Work With Us page, complete the quick questionnaire and book a discovery call! We can then chat through your plans and how we can help bring your plans into reality.

Our Top 3 related blogs:

- What is a registered address and why do I need one?

- Bank Recommendation – Spoiler alert – it’s Starling Bank!

- Why it pays to ask your accountant to set up your limited company