Under the minimum wage legislation, workers must be paid at least the statutory minimum wage for their age. There are two types of minimum wage, the National Living Wage (NLW) and the National Minimum Wage (NMW). From 1 April 2021, as well as the usual annual increases, the age threshold for the National Living Wage has been reduced.

National Living Wage (NLW)

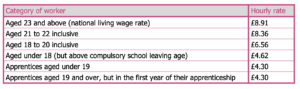

The NLW is a higher statutory minimum wage payable to workers whose age is above NLW age threshold. This used to be payable to workers age 25 and above. However, from 1 April 2021, the NLW age threshold has been reduced and from this date it must be paid to workers aged 23 and above.

National Minimum Wage (NMW)

The NMW is payable to workers who are below the age of entitlement to the NLW . The NMW used to apply to any workers above compulsory school leaving age and under the age of 25. However, from 1 April 2021, the NMW must be paid to workers under the age of 23 and over the school leaving age.

There are three NMW age bands:

- Workers aged 21 and 22 (prior to 1 April 2021, workers aged 21 to 24)

- Workers aged 18 to 20

- Workers aged 16 and 17

Apprentices

There is also a separate NMW rate for apprentices. It is payable to apprentices under the age of 19 and also to those who are over the age of 19 and in their first year of their apprenticeship.

Employer Responsibility

Employers must ensure that they are paying workers on the NLW or NMW at the new rates from the 1 April 2021.

It is also important to ensure that there is a process in place to identify when a worker moves into a new age bracket. From the 1 April 2021 employers will also need to identify all workers who are 23 and 24 who will now also be entitled to the NLW.

How PPF Can Help

As part of our Payroll Service we will ensure that your employees are paid in line with these minimum levels, and therefore keep you compliant.

If you need help with your payroll, let’s have a chat – head over to our Work With Us page, complete the quick questionnaire then at the end there is a link to book a discovery call with us.

Source: HMRC